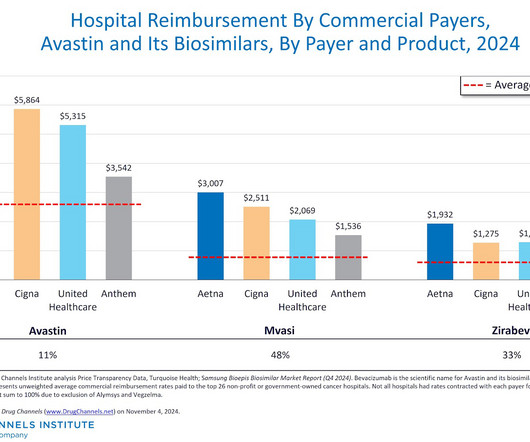

Transparency Shocker: Biosimilars Are Getting Cheaper—But Hospitals and Insurers Can Make Them Expensive

Drug Channels

NOVEMBER 4, 2024

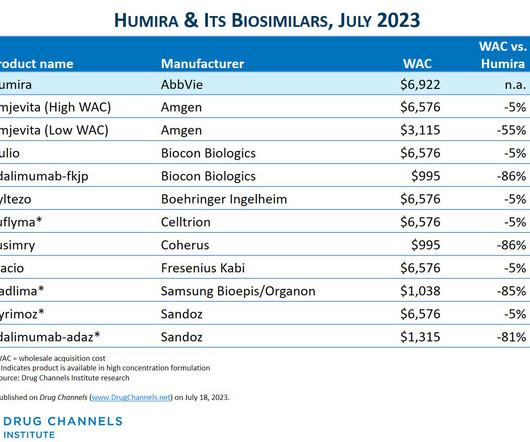

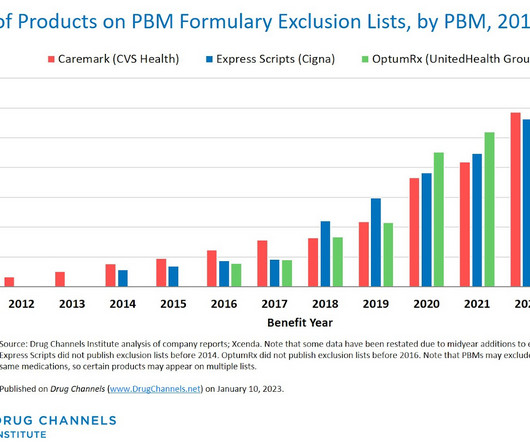

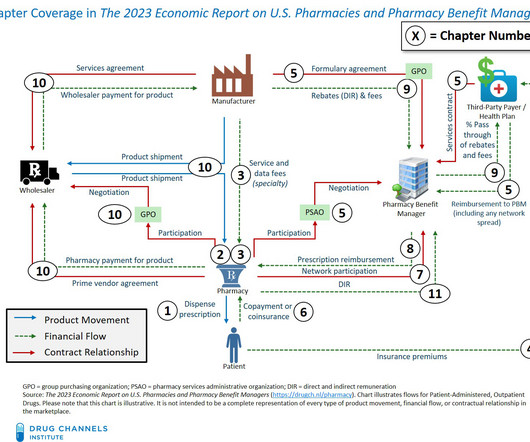

Here on Drug Channels , we have long highlighted the boom in provider-administered biosimilars. In contrast to the pharmacy market, adoption of these biosimilars is growing, prices are dropping, and formulary barriers continue to fall. What would happen if we disinfected the entire channel? All rights reserved.

Let's personalize your content