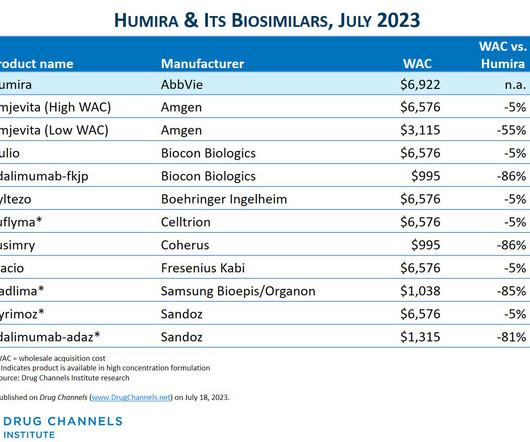

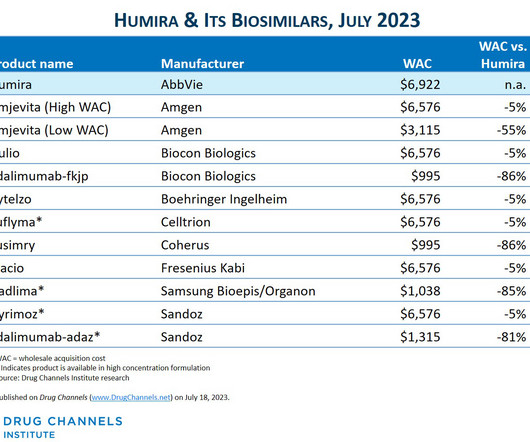

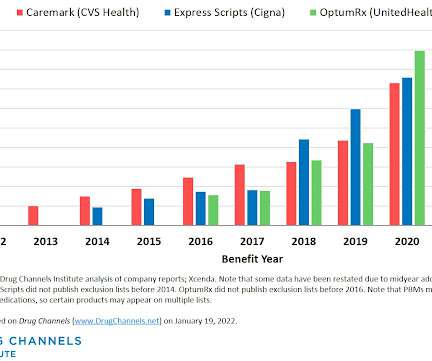

The Big Three PBMs’ 2023 Formulary Exclusions: Observations on Insulin, Humira, and Biosimilars (rerun)

Drug Channels

MARCH 28, 2023

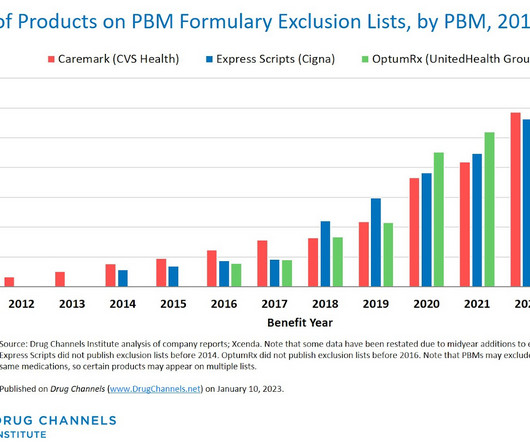

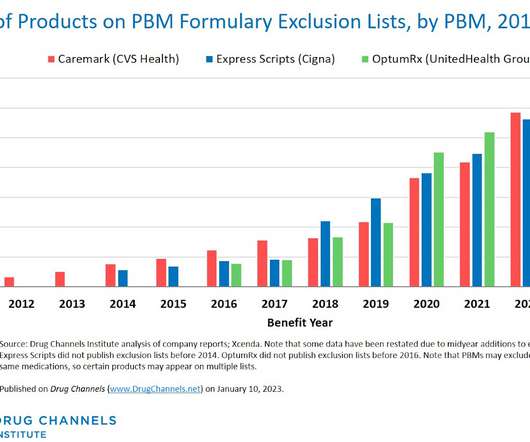

This week, I’m rerunning some popular posts while I prepare for this Friday’s live video webinar: Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook. Each exclusion list now contains about 600 products. Click here to see the original post and comments from January 2023.

Let's personalize your content