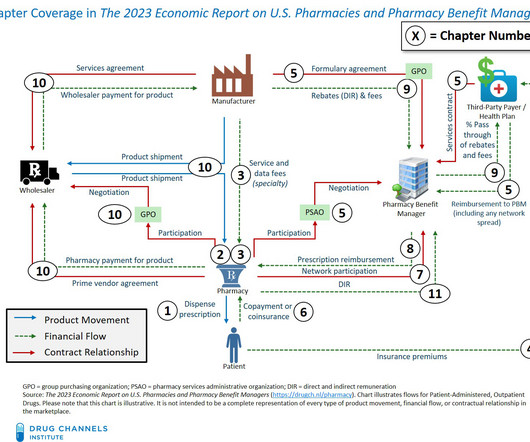

NOW AVAILABLE: The 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers

Drug Channels

MARCH 14, 2023

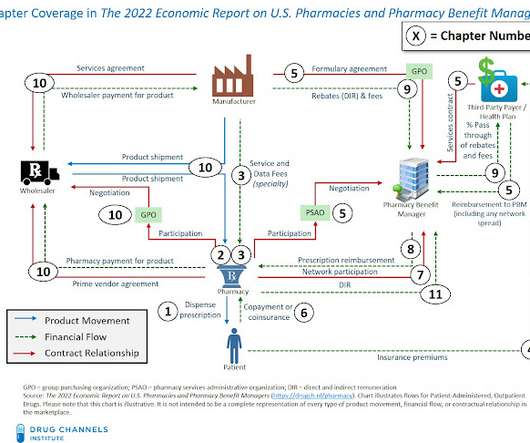

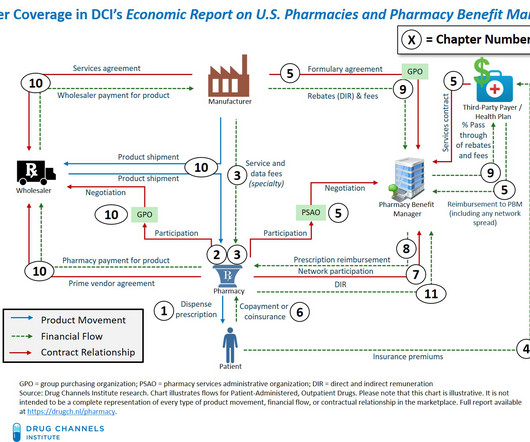

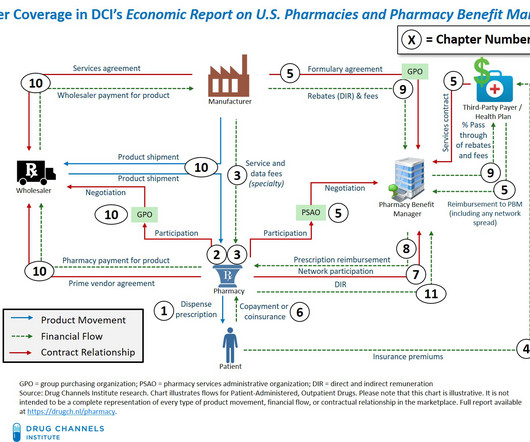

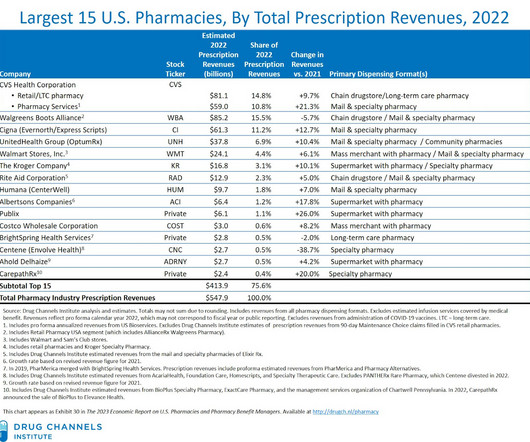

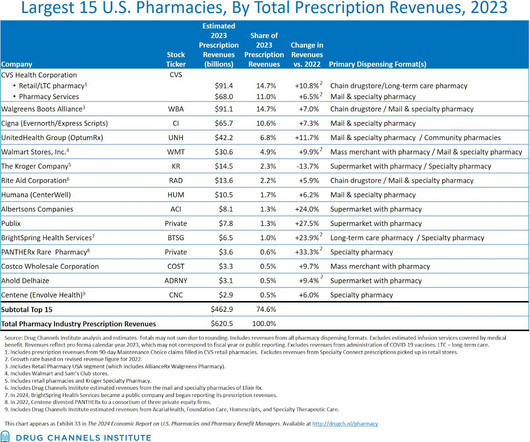

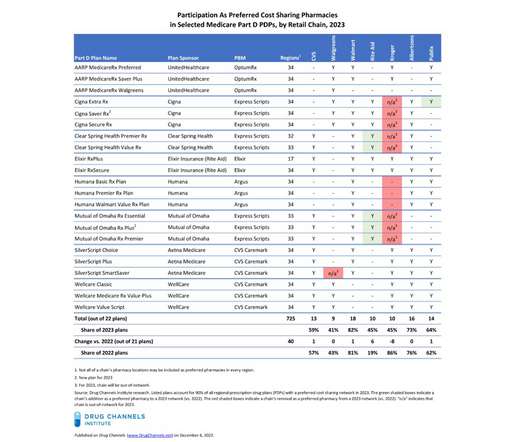

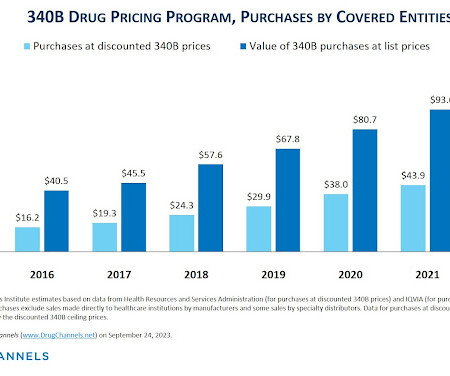

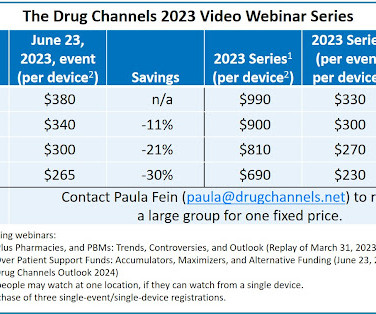

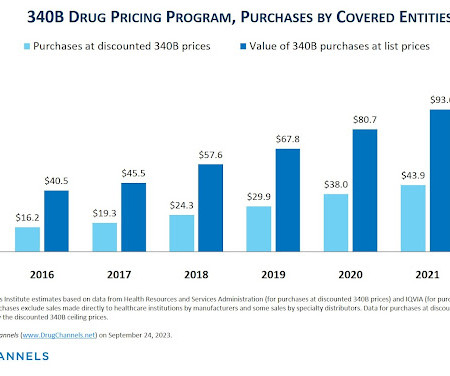

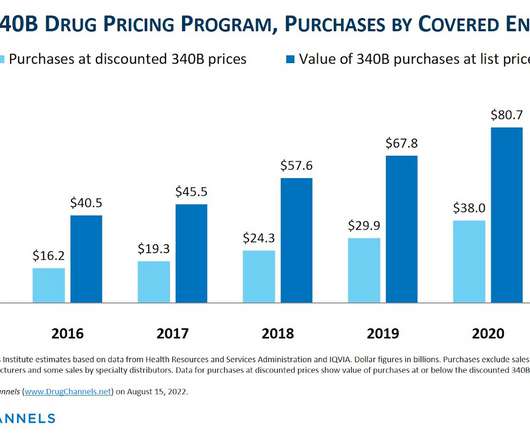

Pharmacies and Pharmacy Benefit Managers , available for purchase and immediate download. Click here to download a free report overview (including key industry trends, the Table of Contents, and a List of Exhibits) New Drug Channels Institute Study Analyzes Impact of Inflation Reduction Act on U.S.

Let's personalize your content