Five Things to Know About the State of Independent Pharmacy Economics

Drug Channels

FEBRUARY 15, 2022

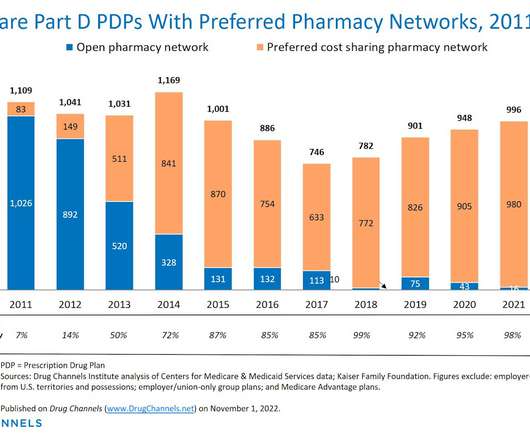

Time to update Drug Channels' exclusive look at independent pharmacy owners’ business economics. Our analysis again reveals that despite what you may have heard, many independent pharmacies continue to hang on in a highly challenging retail environment. Expect independents to keep hanging in there.

Let's personalize your content