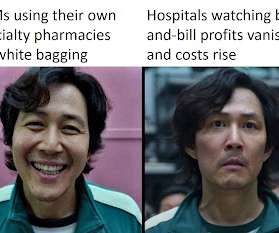

Vertical Integration Lessons: The Economics and Strategies of Hospital-Owned Specialty Pharmacies

Drug Channels

NOVEMBER 7, 2023

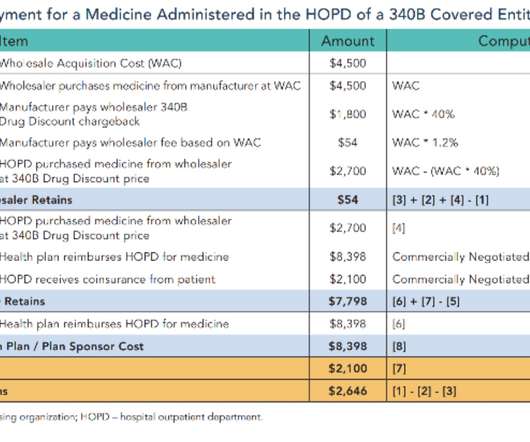

As many of you know, hospitals and health systems have emerged as significant participants in the specialty pharmacy industry. A new American Society of Hospital Pharmacists (ASHP) survey provides fresh insights into these specialty pharmacies. drug channels gets most of the attention. d/b/a Drug Channels Institute.

Let's personalize your content