Medicare Part D in 2024: The Seven Largest Companies' Preferred Pharmacy Networks and the Coming Collapse of the PDP Market

Drug Channels

OCTOBER 24, 2023

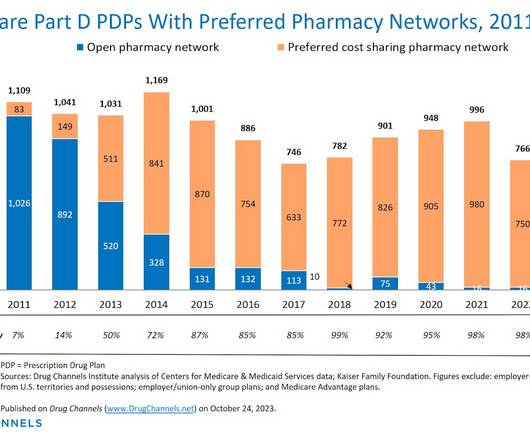

In upcoming articles, I’ll delve into chain and independent pharmacies’ participation in the major 2024 preferred networks. The 2024 data provide early evidence of a shrinking PDP market. I also update our analysis of the prevalence of preferred networks in three different types of MA-PD plans.

Let's personalize your content