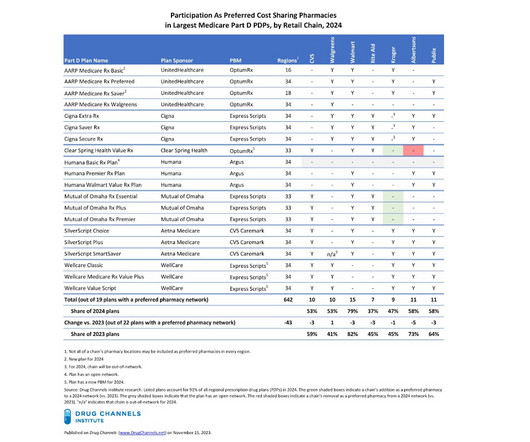

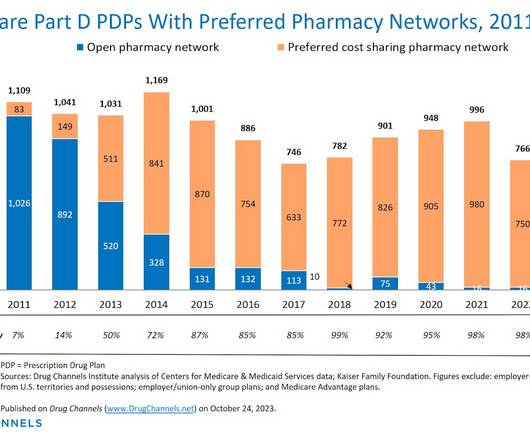

Medicare Part D in 2025: Preferred Pharmacy Networks Fade in a Collapsing PDP Market

Drug Channels

NOVEMBER 13, 2024

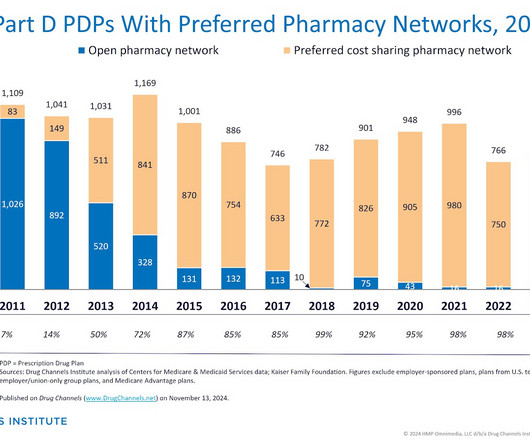

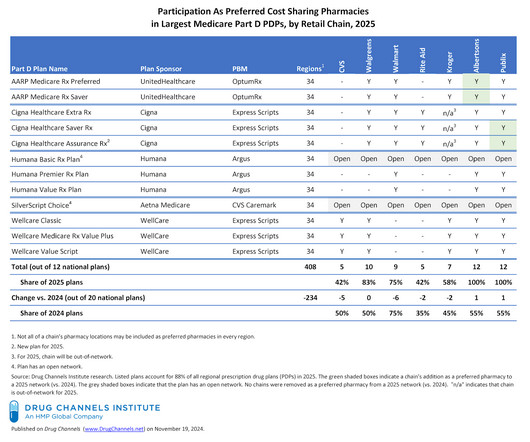

As I predicted, the stand-alone Medicare Part D prescription drug plans (PDP) market is vanishing. What’s more, the share of plans with a preferred cost sharing pharmacy network will fall to its lowest rate in more than 10 years. Legislate in haste. Repent in leisure. What else should you expect for 2025? to 1:30 p.m.

Let's personalize your content